If you ask most Nigerian parents, especially those who are less affluent, why they have so many children, you’ll often hear three reasons: they’re hoping for a male child, they want many children to care for them in old age, or they believe children are a gift from God. Consequently, family planning isn’t taken seriously.

I can’t remember when I first heard the term “black tax,” but I was in my early twenties, fresh out of university, and stumbled upon it. Please, don’t judge me; we learn every day. I remember my peers, also fresh graduates, feeling burdened to start supporting their siblings or sending money home. They had just finished school and had no jobs—where were they supposed to get the funds? Some families even start asking their kids in uni to send money home, it’s sad.

While I don’t have a deeply sobering “grass to grace” story, as my mum shielded me from much hardship by ensuring I went to good schools and I had some help from extended family, I am not oblivious to what black tax means.

So, what is black tax?

It refers to the practice where young black people, especially Africans and Caribbeans, send money back home to their parents, assist in training their siblings, and help run the household.

Sending money back home is a noble thing to do; it’s important to help your family, especially when you have the means. However, for many African parents, it doesn’t matter if you have the means or not—they believe it’s your duty to look after your family. Whether you can afford it or not, that’s on you. Let me paint a picture for you.

Adaora’s Story

Adaora, the first daughter in a family of six, just graduated from university. Her family is so poor that Ada had to run several businesses while in school—from making pastries to doing hair—to survive. Despite attending a Federal University with relatively affordable fees, her parents couldn’t pay. Somehow, Ada managed to graduate, funding her education with little or no help from home. As she prepares for her clearance, her parents are already pressuring her to send money home.

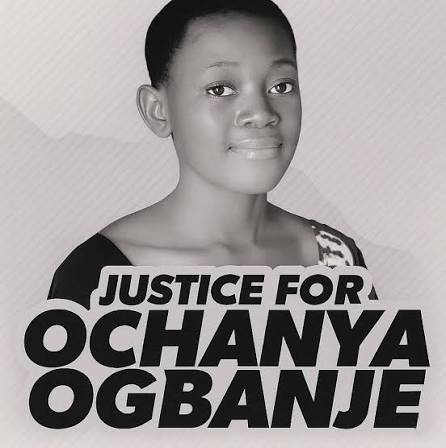

Where they expect Ada, who doesn’t yet have a job, to get this money, is unclear. Under pressure to help her siblings, she starts borrowing money from friends, but the demands from her parents don’t stop. They even find a “suitor” for her—a man in his late thirties whom Ada doesn’t love but promises to train her five siblings if she marries him. Despite not wanting to, her family pressures her, saying, “You have to marry him to help us.” Ada becomes a sacrificial lamb, marries him, and endures his abuse. When she reports this to her family, they urge her to stay, saying every marriage has its ups and downs and that she should endure for the sake of the family.

Alex’s Story

Alex, a young man in his late twenties, finally found a job after a long job hunt, earning 100,000 Naira. Barely surviving, he lives with his uncle in Egbeda and works in VI. A few days after payday, Alex is broke. He is the eldest of three siblings and is expected to pay their fees and support his parents.

His parents don’t ask how he’s coping or saving; they only care about Alex helping them. With his new job, Alex is drowning in debt, borrowing from friends to cover the endless bills for his family. His parents are against him getting married because they fear a new wife would stop him from sending money home.

Olu’s Story

Olu is on a student visa in the UK, a feat that put him in debt. He hasn’t finished paying his fees, only managing to pay a deposit before moving. Combining school and work under harsh conditions is tough, but his family constantly pressures him for money. They monitor exchange rates and bill him when he doesn’t send enough. Struggling to complete his fees, Olu is drowning in debt, with his family relentlessly demanding more.

Osato’s Story

Osato’s parents are not struggling financially, but they believe that since she has a good job and no husband or kids, she has nothing else to spend her money on. They call her for everything: paying for extended family expenses, numerous parties, and more. At the end of the month, her bank account is red.

Cutting her family off is difficult because, as an African, it’s not easy. Like many millennials and Gen-Z kids, Osato is going through a lot, with barely any funds left after payday.

The Impact of Black Tax

Recently, I listened to the podcast “I Said What I Said,” where someone shared that her fiancé barely has anything left after sending money to his parents and siblings. While she has some money, she’s worried about marrying him due to his financial obligations. People often hesitate to marry someone with so many responsibilities, and family members sometimes discourage marriage, fearing they might lose financial support.

Setting Boundaries

My previous post addressed first daughters, emphasising the importance of boundaries. I’m not against sending money home; I pay my fair share of black tax, though it’s mild because my family can manage without my input. However, black tax is an issue that affects millennials, and we cannot afford to repeat the mistakes of our parents.

Managing Black Tax as Millennials and Gen-Z

Have the Number of Kids You Can Afford: We can’t keep blaming our parents for their mistakes; they didn’t know better. My grandparents had 10 kids hoping for a male child. We need to have only the number of kids we can afford. The economy is tough enough. Don’t have numerous children expecting extended family to help raise them or hoping your kids will take care of the remaining kids. If they help, great; if not, they’re not the bad guys.

Don’t Have Kids Immediately After Marriage: If you’re not ready mentally and financially for a child, don’t rush into having one just because you’re married. It’s okay to wait. Of course, people will talk. They’ll start dropping hints about kids or saying things like “I’m praying for you, God will do it and remove barrenness from your family.” Pay them no mind. Most Africans do not understand that people get married and are unwilling to have kids or even choose to wait for a while before having kids so they’ll be a bit prepared. Don’t be pressured to have kids if you aren’t ready.

Track Your Finances: Know where your money is going. This will help you make better choices and plan accordingly. If black tax is draining your pocket, start making plans. Put some money away for yourself, pay your debt, be smarter with your money.

Do What You Can: If something happens to your job, your family will find a way to cope. They will be fine. Do what you can, but don’t overextend yourself. I’ve seen situations where families are fine when the breadwinner is out of a job. Please, do what you can, you are someone’s child too and you deserve to rest.

Learn to Say No: Saying no is liberating. Start early, and your family will eventually understand. If you can’t afford it, say no. They won’t beat you.

Teach: Instead of just giving money, find ways to teach your siblings to be excellent in their fields. Talk to them about internships, scholarships, and career paths. Help them learn the value of hard work.

Avoid Debt: Don’t go into debt to please people at home. High blood pressure doesn’t look at age anymore, young people are dealing with it too. Don’t let anyone pressure you into debt.

Don’t Let Them Blackmail You: Set healthy boundaries and let your family know that you won’t be blackmailed by shame or societal expectations. “What will people say? My son is the US and cannot afford to pay for this for his own mother?” Don’t fall for that trap please.

Helping family is a big part of our culture as Africans, and it’s a culture I love. However, it’s crucial to ensure that the person giving help isn’t losing their mind. We’ll talk more about this in future blog posts, where I will interview people who’d like to share their black tax stories. If you haven’t subscribed to my blog yet, please do so to get notified when a new post is up.

Leave a reply to GiftWogu Cancel reply